The Timeless COMPETITION Continues!

Let’s rally together in support of girls education, Walker’s exceptional faculty, and this generation of Suns and Dials! EVERY gift May 6-16 will be matched and the spirit club with the most gifts will be victorious. Show your spirit!

Your gift to Walker’s helps provide exceptional educational opportunities to young women with unlimited potential.

You can make your gift in a number of ways. Whatever method is best for you, we thank you for making Walker’s a philanthropic priority.

Your gift to Walker’s helps provide exceptional educational opportunities to young women with unlimited potential. You can make your gift in a number of ways. Whatever method is best for you, we thank you for making Walker’s a philanthropic priority.

The simplest method of giving is an outright gift of cash. Only the amount given to the School in a particular tax year is deductible for income tax purposes, consistent with Internal Revenue Service regulations. Gifts of cash are deductible in any tax year to an upper limit of 50% of your adjusted gross income. Any balance of the deduction remaining may be carried forward and deducted to similar limits in the five succeeding tax years.

You may be able to double or even triple your gift to the Annual Fund for Walker’s by seeking matching gifts from your employer. If you serve on a board of an organization, that organization may also provide matching gifts. We are most grateful when donors take extra time to use the below matching gifts tool or contact their personnel office to see if such matching gifts are possible at their companies. If you make your gift online, please send in your matching gift form separately to The Ethel Walker School Advancement Office, 230 Bushy Hill Road, Simsbury, CT 06070. Please send documents with original signatures.

The Ethel Walker School Tax ID: #06-0689699

For more information, please contact Advancement Database Assistant Liana Sowa at lsowa@ethelwalker.org or +1-860-408-4258.

A gift of appreciated securities, held for a minimum period of one year and one day, may offer you significant tax benefits.

You will be entitled to claim a charitable contribution deduction for the full fair market value of the donated securities on the day they are delivered or transferred to the School. You will avoid all capital gains tax liability for the appreciation in value for securities transferred directly to the School.

Gifts of appreciated securities are deductible for tax purposes to an upper limit of 30 percent of your adjusted gross income in the year of your gift. Any balance of the deduction remaining may be carried forward and deducted to similar limits in the succeeding five tax years.

For gifts of stock or mutual funds, please alert Director of Development, Leila Howland Wetmore, ’82. P’18 at +1 860-408-4250 or lwetmore@ethelwalker.org, providing stock name, total shares, your broker’s name, anticipated transfer date and designation of your gift to Walker’s.

The Ethel Walker School DTC: #0164

Account: #3168-2244

The Ethel Walker School Tax ID: #06-0689699

Agent Bank and Contact:

Charles Schwab & Co.

43 LaSalle Road

West Hartford, CT 06107

Fax: +1-860-570-4051

Attn: Michelle Duer, Broker

SWIFT Code: KEYBUS33

Beneficiary Information:

Bank: KeyBank N.A.

Routing Number: 021300077

Bank Location: 4910 Tiedeman Road, Brooklyn, OH 44144

Name: The Ethel Walker School, Inc.

Account Number: 7901016894

Address: 230 Bushy Hill Road, Simsbury, CT 06070

Gift Reference: Annual Fund for Walker’s or another designation

For further information, please contact Chief Financial and Operations Officer Beth McWilliams P’28 at bmcwilliams@ethelwalker.org or +1-860-408-4241.

You may also choose to support Walker’s long-term financial health through a planned gift, which is usually designated for the endowment, unless you have a specific request. The endowment provides critical income for the financial stability and growth of the School.

The simplest planned gift is a bequest naming the School as a beneficiary; other options include IRA charitable rollover, life insurance, life income gifts, gifts of future interest in real estate or a charitable lead trust. For more details, please review our Planned Giving information or contact Assistant Head for Advancement Gretchen Orschiedt at gorschiedt@ethelwalker.org or +1-860-408-4260.

The Ethel Walker Heritage Society honors donors who have made planned gifts to the School.

You may prefer to fund your contribution with a gift of real estate. This may be done as a simple outright gift, where the property is given directly to the School, or as a gift with a retained “life estate.” The gift with a retained life estate allows you to take advantage of the immediate tax benefits of a charitable gift even while you continue to live in and enjoy the property. Please consult Assistant Head for Advancement Gretchen Orschiedt at gorschiedt@ethelwalker.org or +1-860-408-4260. for additional information about gifts of securities, life insurance, and real estate.

Gifts of items that the School might otherwise have to purchase are welcome and constitute donations for tax purposes. Examples of such in-kind gifts include consulting services, sporting equipment, artwork, books, furniture, and horses for the Equestrian Center.

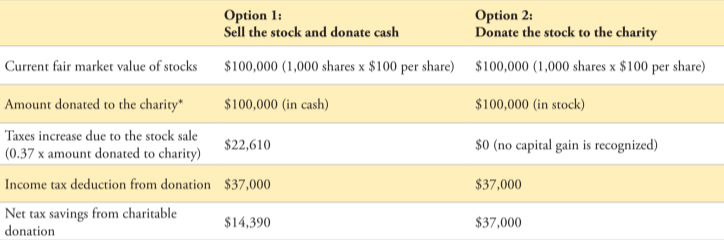

Donating long-term assets — especially highly appreciated securities held for over one year — instead of cash can be a very effective and tax-efficient way to support Walker’s. Generally, if your assets have appreciated in value, it’s more efficient to transfer stock instead of cashing it in and then making your contribution. Contributing the securities directly to Walker’s increases the amount of your gift as well as your potential tax savings.

The sample is hypothetical and provided for illustrative purposes only.

*Assumes a cost basis of $5,000, that the investment has been held for more than a year, and that all realized gains are subject to a 20% long-term capital gains tax rate and the 3.8% net investment income tax. The analysis does not take into account any state or local taxes.

How it works:

Benefits:

For gifts of stock or mutual funds, please notify Director of Development Leila Howland Wetmore ’82, P’18 at lwetmore@ethelwalker.org or +1-860-408-4250, providing stock name, total shares, your broker’s name, anticipated transfer date, and designation of your gift to Walker’s.

You can provide the following to your broker:

The Ethel Walker School DTC: #0164

Agent Bank and contact:

Charles Schwab & Co.

43 LaSalle Road

West Hartford, CT 06107

Fax: +1-860-570-4051

Attn: Michelle Duer, Broker

Account: #3168-2244

School Tax ID: 06-0689699

Director of Development and the Annual Fund

lwetmore@ethelwalker.org860-408-4250

Leila has worked for and provided consulting services to organizations including Planned Parenthood of New York City, Lenox Hill Hospital, The American Field Service, the National Academy of Design, and most recently served as the Executive Director of the Darien Nature Center.

Learn More